Xero Tip - Reviewing & finalising GST returns

Categories

When your GST is due to be filed, there are a couple of checks to make first:

- Run Bank Reconciliation Reports for all bank accounts you have loaded in Xero. This will show if there are any items that need attention (to be reconciled etc). Double check your bank balance to your actual bank

- If you are on Invoice basis GST, ensure that all of your Bills and Invoices have been entered for the period.

- Review your coding – to do this, the quickest & easiest way to review is through your GST Audit Report.

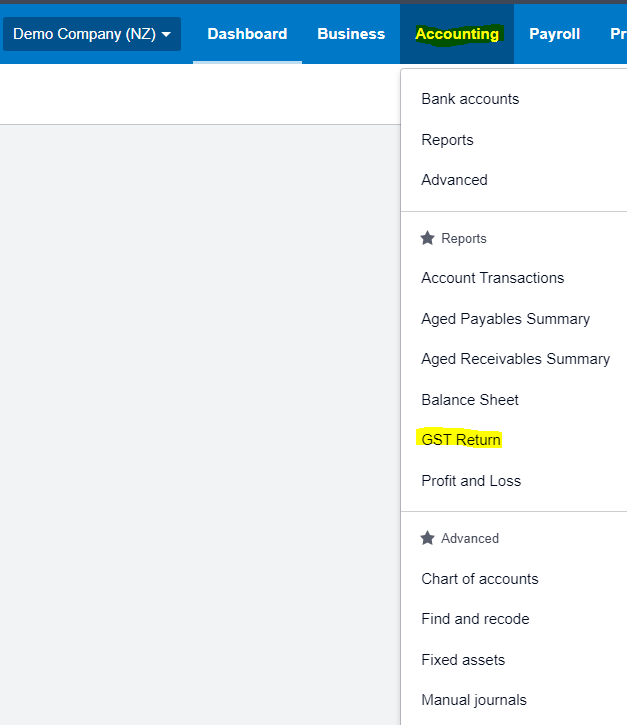

Select Accounting, then GST Return – (if GST Return is not an option in the dropdown, go to Reports, then GST Return)

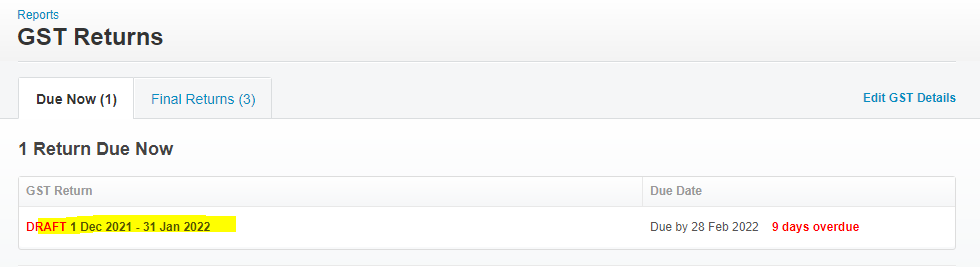

Select the GST Return you are due to file (you can select anywhere in this box):

This will now open up the GST Return and will show you the summary GST101 report that is filed with Inland Revenue.

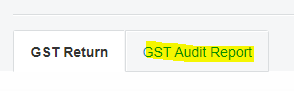

You will note there are two Tabs, with the headings “GST Return” and “GST Audit Report”.

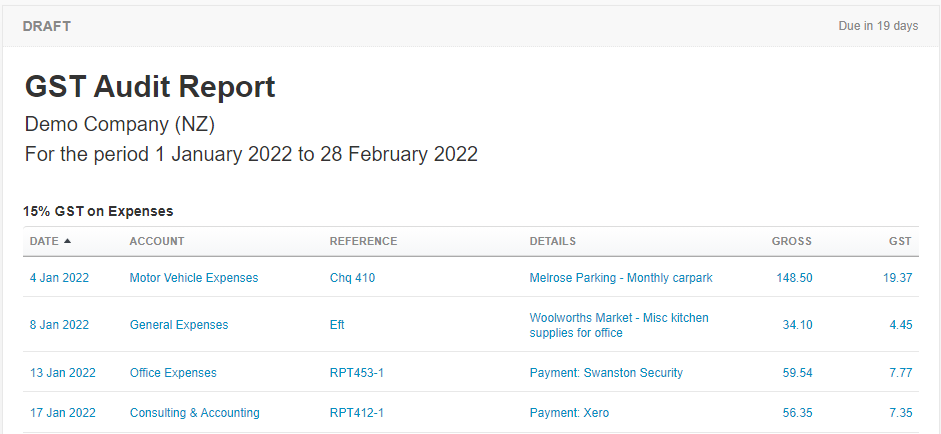

Select the GST Audit Report, this is the detailed report and will show your coding:

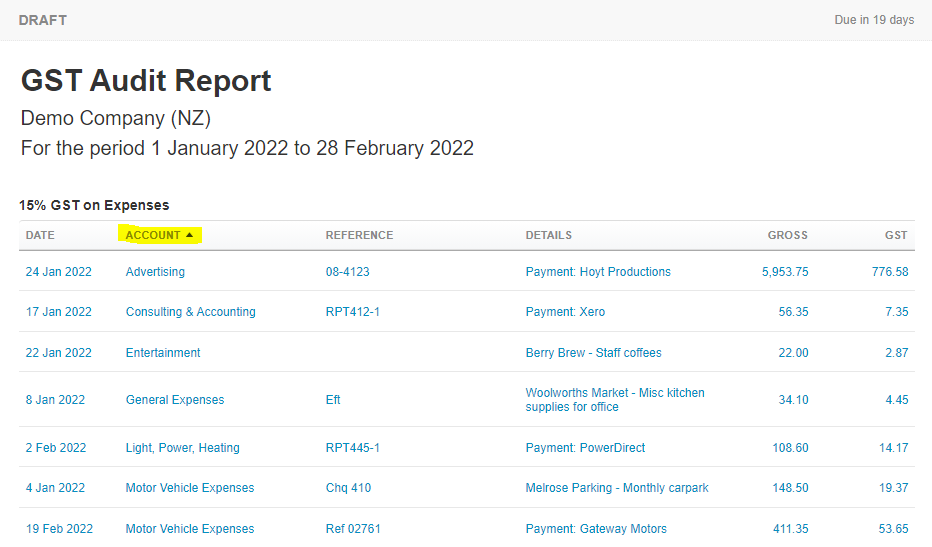

The report defaults to sort by date, but you can select any of the column headings to sort by this heading, for example, a great way to check coding is by Selecting the column called “Account”. This lets you review your coding by each Account code:

Scroll through this report and review to check your coding. Note; it is broken into sections

- GST on Expenses

- GST on Income

- NO GST

Make sure to review all sections.

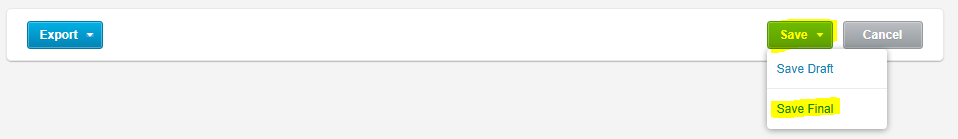

Once you are happy with your coding and are ready to file your GST Return, go back to the GST Return tab. Take note of whether you have GST To Pay for a Refund due.

At the bottom of the page, Select Save (the green button) and select Save As Final:

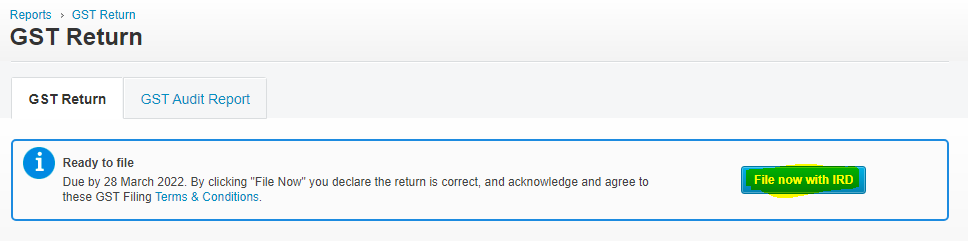

You GST Return is now finalised and ready to be filed with Inland Revenue. If you have a MyIR login to Inland Revenue, a really quick way to get your GST Return to IR, is to select at the top of the page, File now with IRD:

Xero will then go through the process to connect with your MyIR and automatically send your information through to Inland Revenue

Please Note – if you have GST To Pay, you still need to go to your banking system to make the payment to Inland Revenue, Xero DOES NOT do this as part of the automated process.

Need more assistance? Get in touch with us today!

- News

Alex Crackett

Alex Crackett

Craig McCallum

Craig McCallum