Changes to farm dwelling expenditure

Categories

On 23 March 2017 Inland Revenue finalised interpretation statement 17/02 Income Tax – Deductibility of Farmhouse Expenses.

This interpretation statement changes how farm dwelling expenses are claimed for income tax purposes and how much can be claimed for GST purposes. This interpretation statement will apply from the beginning of the 2018 income year. This means for March balance dates, from 1 April 2017, May balance dates, from 1 June 2017, and for June balance dates, from 1 July 2017.

Under Inland Revenue’s current view farmers are, generally, entitled to claim full income tax deductions for both rates and interest payable on farm loans, despite the fact a proportion of these expenses relate to the farm dwelling. Furthermore, Inland Revenue has allowed farmers an income tax deduction and GST claim equal to 25% of the expenditure incurred in relation to the farm dwelling, for example, electricity and dwelling repairs (special rules can apply to companies and trusts).

Under the announced changes, farmers are classified into Type 1 (essentially larger farms) and Type 2 farms (essentially smaller farms). Where the value of the farm dwelling (including curtilage and improvements) is 20% or less of the total value of the farm, the farm is a Type 1 farm otherwise it is a Type 2 farm. The Commissioner will accept the following as a reasonable estimate of the value of the farm:

- Rateable value - however, the usefulness depends on the circumstances as the value of the dwelling may not be readily available.

- Bank valuation or real estate agents appraisal - however, a formal valuation will be appropriate if a farm is on the borderline of both Type 1 and 2.

- Cost - if the relative costs are comparable and contemporaneous e.g. the cost of a farm in 1990 and the cost of a new farmhouse in 2010 are not comparable or contemporaneous. The below table summaries the income tax treatment of dwelling expenditure for each type of farm:

Under the changes, Type 2 farms will no longer be able to claim 100% of any loan interest or rates in relation to the farm dwelling and must substantiate the claim for other dwelling expenses for income tax purposes. This will require Type 2 farms to calculate how much of the farm dwelling is used for business purposes (for example on a time and area basis) and claim a proportion of dwelling expenses (loan interest, rates, electricity, and repairs) on that basis.

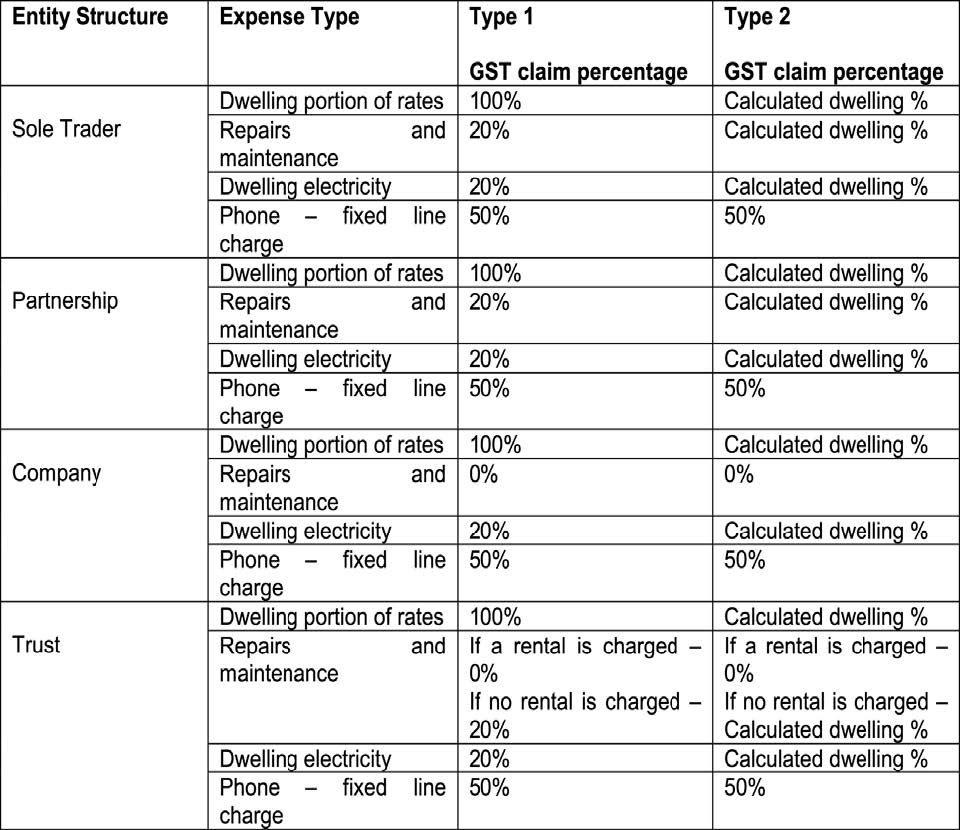

Type 2 farms operating in a partnership or sole trader structure will be able to claim GST on farm dwelling rates, electricity, and dwelling repairs to the extent of this same percentage. For companies, the rules remain unchanged for dwelling repairs and maintenance expenditure ie there is no GST claim. For example, if, based on an area and use basis, a Type 2 farmer (in a partnership structure) uses 10% of the dwelling for business purposes (i.e. a home office), then for GST purposes they would claim 10% of repairs and maintenance, electricity and dwelling rates. Larger farms (Type 1) will still be able to claim 100% of loan interest & rates.

However, for other dwelling expenses, only 20% can be claimed for income tax and GST purposes, unless a larger claim can be substantiated. This could be done by using the same approach for Type 2 farms in determining the percentage of the dwelling used for business purposes. Again, there is no change for a company’s dwelling repairs and maintenance expenditure for GST purposes, ie there is no GST claim.

From a GST perspective, this affects you now! What do you need to do?

1. Every farmer needs to first establish if they are Type 1 or 2.

This is done by using one of the three methods outlined above; rateable value, valuation, or cost. The simplest method would be to use cost. This can be used when the costs are

comparable and purchased around the same time. If a dwelling was later constructed a combination of cost and rateable value may have to be used.

For example:

Hayden is a sole trader who owns and operates a dairy farm. Hayden purchased the farm in the 1980s for $490,000. Hayden also purchased a run-off block in 2001 for $30,000. Hayden demolished and replaced the original farmhouse with a new build in late 2016 in which he and his family live. The new farmhouse cost $460,000. Hayden wants to know how to work out whether he is a Type 1 or Type 2 farmer.

The respective values of the farm and farmhouse should be used to work out whether the farm is a Type 1 or Type 2 farm. Hayden has the option of using cost but in this case the cost is unhelpful as he would be comparing the historic cost of the farm with the recent cost of the newly built farmhouse.

The $460,000 cost of the new farmhouse can be used as an approximation of the current market value. The farm’s updated 2017 rates bill has the rateable value of the whole farm as $4,300,000. Hayden considers that is a reasonable approximation of the market value and decides to use this figure for the threshold calculation. Although the rates bill is for 2017, the two values are sufficiently contemporaneous to use in the threshold calculation.

The run-off block is on a separate title. However, as it is farmed together as part of the same farming enterprise it can be taken into account when calculating the farm’s value. The 2017 rateable value for the run-off block is $45,000. The value of the farmhouse is $460,000 and the rateable value of the farm (including run-off block) is $4,345,000. The farmhouse is therefore 10.6% ($460,000 / $4,345,000) of the value of the farm. Even allowing for the value of the curtilage, Hayden is a Type

1 farmer (percentage less than 20%). Where it is obvious what type of farm the farm is a simple analysis, like the one above, will be appropriate. Where the distinction between Type 1 and 2 is very close a market valuation may be required.

After completing Step 1 you are classified as either a:

- Type 1 farm i.e. larger farm where the farm dwelling’s value is less than 20% of the total farm’s value; or

- Type 2 farm i.e. small farm where the farm dwelling’s value is more than 20% of the total farm’s value.

2. If you are Type 2

Farmers must undertake a “home office” calculation like any other taxpayer who carries on their business from home. This calculation must be based on the actual use of the farmhouse (for example, on a time and space basis), regardless of whether there is a dedicated home office or different parts of the house are used in the business.

If an office space is available and no other area of the house is used the calculation is relatively straightforward. For example, the floor area of the office is 10m2 and the total floor area of the farm dwelling is 100m2. In this example, the home office is 10% of the farm dwelling (10m2 / 100m2) so 10% of the farm dwelling expenses can be claimed for GST purposes.

If there is no dedicated office space the calculation is more complicated. For example, Anaru and Angela hold business meetings at the kitchen table and manage the farm accounts from the family computer in the dining room. In addition, Angela sometimes prepares lunches for business visitors in the farmhouse kitchen. The floor area of Anaru and Angela’s house is 150m2. Together, the dining room and kitchen make up 40m2 in total or 27% of the floor area of the farmhouse. Anaru calculates, on a fair and reasonable basis, that these rooms are used for the farm business for 20% of the time. This means that the business use of the farmhouse is 5.4% (20% x 27%).

Anaru and Angela could claim 5.4% of farm dwelling expenses for GST purposes. Laundry and garage areas which are typically used to store farm clothing and equipment should also be taken into consideration when determining the area used for business purposes.

3. GST can be claimed on-farm dwelling expenses based on the following table

Note: for the calculated dwelling % refer to point 2.

For GST purposes these new rules apply from the beginning of the 2018 income year. Therefore, if you have a March or May balance date these rules are in now. These rules are complicated and you may need assistance from us. Please contact us if you would like us to help you with this. Alternatively, we can calculate the correct percentage GST claim when we complete your 2017 or 2018 financial statements. However, it is likely that the amount of GST claimed throughout the year will be higher than what you are entitled to claim. This will result in having to pay back GST. We recommend you review the amount of farm dwelling expenses being claimed for GST to avoid having to pay back a large amount to Inland Revenue.

Craig McCallum

PrincipalCraig is an expert in reviewing and analysing client’s financial statements and tax returns and provides specialist taxation advice, you can always expect Craig to have his finger on the taxation pulse.

- Tax

Ashley Burdon

Ashley Burdon

Brad Phillips

Brad Phillips

Alex Crackett

Alex Crackett