Xero Tip - Coding livestock sales with shares

Categories

When you sell your livestock to a supplier, i.e. Alliance, Silver Fern Farms, etc, they may deduct a portion off your payment for company Shares (if you hold shares in that Company).

You need to ensure that are coding the share portion as part of the sales so you are understating your income on your livestock.

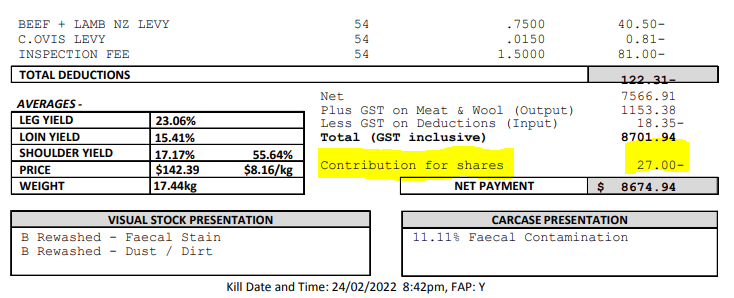

When you receive your kill sheet from your Supplier, take note of any deductions towards your shares – here is an example of an Alliance Kill Sheet showing the share portion:

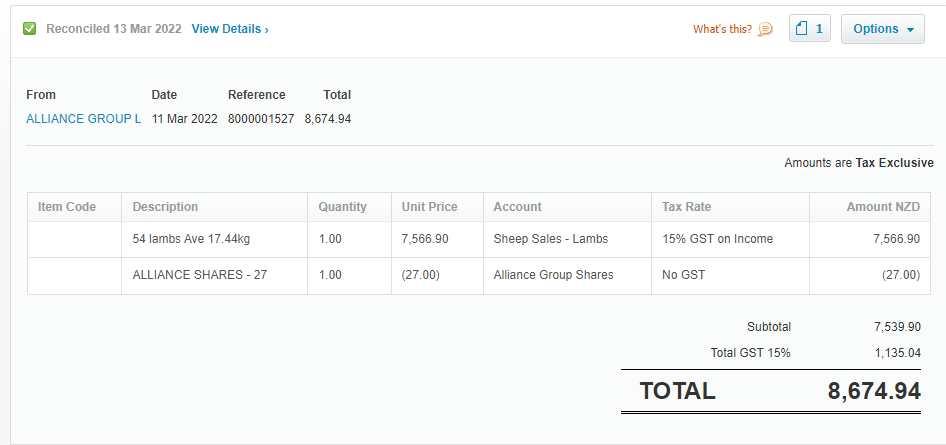

In Xero, we will need to code this deduction to your shares, this would be coded as follows:

You can also see that there is a document attached to this transaction – this is a great place to add your kill sheet, therefore if your Accountant has any queries at Annual Accounts time, they can view a copy of the kill sheet that relates to this transaction.

If you need more help with this give us a call!

- News

Ashley Burdon

Ashley Burdon

Rachel Lock

Rachel Lock

Justine Newsome

Justine Newsome